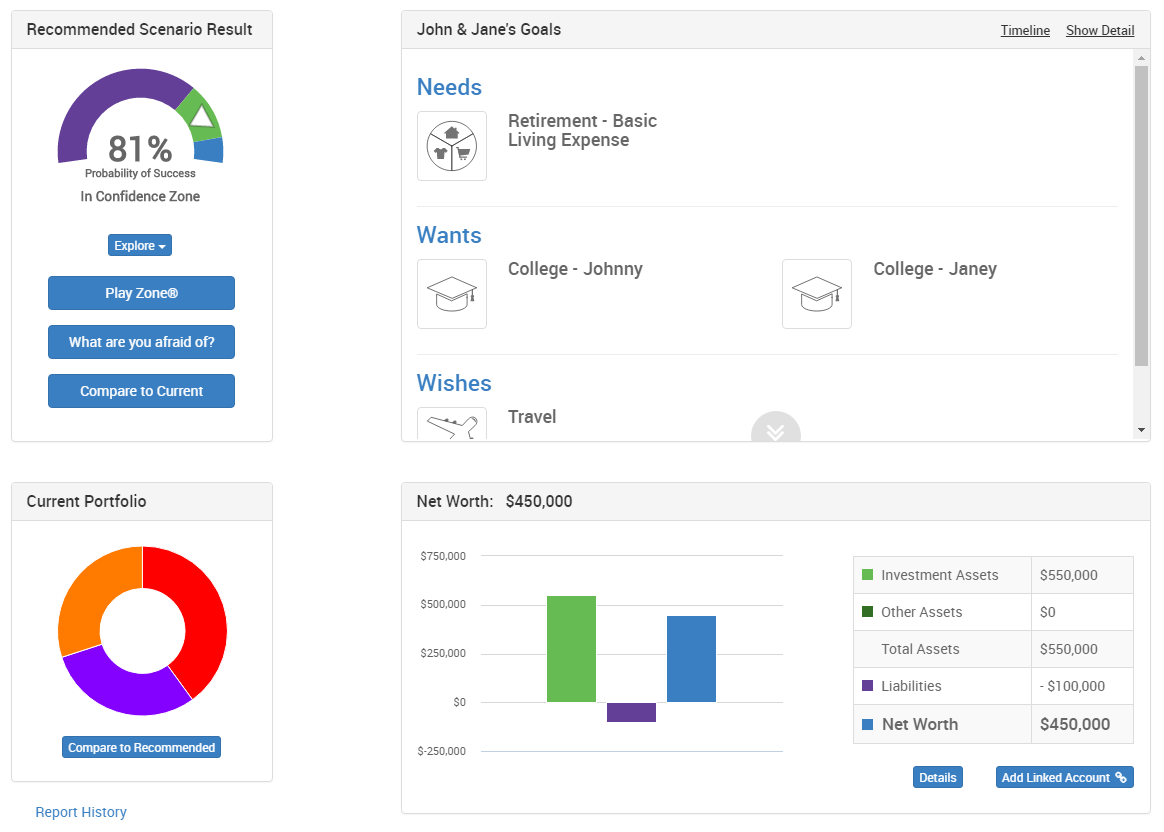

Nothing contained in this piece is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. These views reflect the judgment of the author as of the date of writing and are subject to change at any time without notice. The information, analysis and opinions expressed herein are for informational purposes only and do not necessarily reflect the views of Envestnet. Cheng, Hong, “Income Comparison: Two Approaches for Retirement,”, January 6, 2021,.If you’d like to test how this technology could support better conversation, deeper understanding, and stronger advisor/client relationships in your practice, visit our MoneyGuideElite page to learn more and to sign up for a demo. 1 The new strategy that we’ve added to the Total Income module helps users clearly communicate how this strategy will generate income and prescriptively address client concerns. Income stability is a critical factor in assessing retirement income portfolio options. Advisors need tools that can help their clients evaluate their options and understand how this type of investing might fit into their financial plan. The second use case allows users to account for the fact that more and more clients are now investing in income-generating portfolios, which are designed to provide annual income to the client during retirement. Having a clear picture of where all income comes from, including investment earnings, is a critical piece of information as you help your clients plan for the future. Regardless of how your client grew their wealth, it’s highly likely that they have earned income from a variety of sources. First, it can be used to illustrate investment earnings as a cashflow that assists to fund expenses each year.

This new functionality is valuable for modeling and presenting several different strategies let’s look at two of them. Upon creating the strategy, a new cash flow line item will appear to clearly reflect income from investments available to fund expenses.

To create an income stream, the user can then select a percentage of investment earnings, percentage of account balance, or a set dollar amount to be withdrawn each year. The strategy provides the user with the ability to carve out a portion of the portfolio and allocate it uniquely in its own portfolio model.

We’ve added a new strategy in the Total Income module for MoneyGuideElite SM users, as well as the What If Worksheet for all users, to do just this. Technology has revolutionized how we communicate with our clients, allowing us to interactively address client cashflow questions and model dynamic net worth all in real time. Changes to the plan would have been discussed hypothetically or sketched out on paper before being implemented. Twenty years ago, you would have presented annual cashflow statements containing the latest numbers you could access, and then projected how those numbers may look in the coming year. It sounds simple, but variables like required minimum distributions (RMDs), delayed Social Security benefits, part-time income, deferred compensation, investment earnings, and spending from different tax categories complicate matters. As an advisor, a critical part of your job is to create and communicate a strategy to generate the necessary cash flow in retirement, putting those very valid client concerns to rest. As clients approach and embark on retirement, they are often very uncomfortable as they leave behind the peace of mind and consistency of paychecks.

0 kommentar(er)

0 kommentar(er)